Credit card rewards programs are a great way to earn points that can be redeemed for free flights and other travel rewards such as hotels and car rentals. The trick to making these programs work in your favor is to use your card to pay your bills and continue normal spending habits so you are truly earning points on your usual expenditures and not spending a ton of extra money just so you can earn points.

The largest monthly expense for many is rent and while there are a few ways to pay rent with a credit card, these usually involve high fees that deem it not worthwhile. Bilt Rewards is a new transferrable points rewards program that is looking to change the game by allowing you to earn points on your rent payments—without fees—that you can redeem for travel, paying rent, or even as a down payment on a home.

How to Join Bilt Rewards

While anyone can sign up for Bilt Rewards, it is currently by invitation only. You’ll need to enter your email on the website to join the waitlist. It says priority will be given to residents that live in a Bilt Rewards Alliance property.

The Bilt Alliance network includes nationwide real estate partners such as Camden Property Trust, Cushman & Wakefield, and Highmark Residential, among many others listed on the Bilt Rewards website. If your rental property is managed by one of these companies, you can simply pay your rent through the app and you’ll get 250 points per month.

What if I Don’t Rent From an Alliance Property?

You don’t need to rent from an alliance property to earn points. If your landlord is outside of the alliance, you can still pay your rent through the app and Bilt will send your landlord a check. This means you can still earn points even if your landlord doesn’t accept credit cards. There is no fee for this service but you will need to hold the Bilt Mastercard in order to earn rewards.

Related: What is Track Hacking—and Should You Be Doing It?

Earn More Points With Bilt Mastercard

If you hold the Bilt Mastercard, the points you can earn on your rent will multiply. Afterall, 250 points per month isn’t going to get you very far so if you’d like to give a boost to your points balance, it will be worthwhile to get the Bilt Mastercard as it allows you to earn up to 2 points per $1 of rent.

To determine how many points you will earn on your next rent payment, Bilt uses your monthly non-rent spend on its credit card and assigns a tiered status depending on how much you spend.

- Basic: $0 - $249 in non-rent spend = 250 points per monthly rent payment

- Blue: $250+ in non-rent spend = 1 point per $2 on next rent payment

- Silver: $1,000+ in non-rent spend = 1 point per $1 on next rent payment

- Gold: $2,000+ in non-rent spend = 1.5 points per $1 on next rent payment

- Platinum: $3,500+ in non-rent spend = 2 points per $1 on next rent payment

Normally, you can earn a maximum of 4,000 points per month on your rent. However, new cardholders receive a welcome bonus by earning 3x points on your first rent payment (up to 10,000 points) and will also earn 2x points on non-rent spend for the first 30 days. After the first month, non-rent spend earns 1 point per dollar and you can earn an unlimited number of points on non-rent spend.

Is There an Annual Fee?

No, unlike most credit cards that earn transferable points, the Bilt Mastercard has a $0 annual fee.

How to Redeem Bilt Rewards Points

Rent and Homeownership

There are a variety of ways to redeem points. The most interesting is the fact that Bilt will allow you to use your points to pay rent (if your landlord is part of the Bilt Rewards Alliance) or even use your points towards a down payment on a home.

Making your rent payments through Bilt will improve your credit rating by reporting on-time payments for rent, which doesn’t normally get reported if you simply pay your landlord. Better yet, if you get your financing through Bilt, you can use your points towards a down payment. The redemption value will vary, but Bilt says points are valued at up to 1.5 cents per point when redeemed towards a down payment.

Fitness Classes

Bilt has partnered with group fitness classes such as SoulCycle, Rumble, and Y7. You can use your points for these classes, which start at 3,000 points per class.

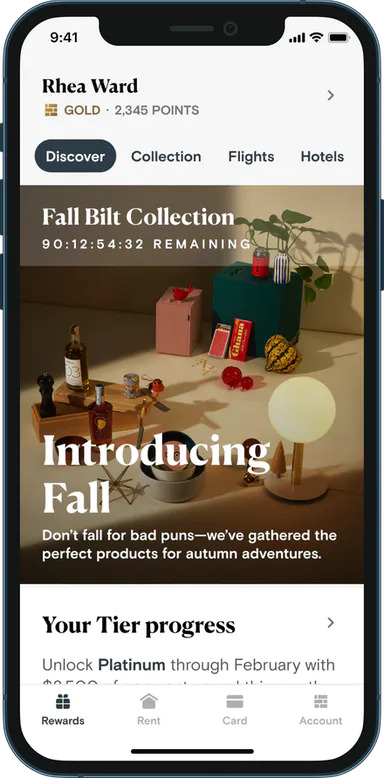

Shopping at the Bilt Collection

Bilt has an in-app shopping catalogue selling all sorts of products including art, home décor, and apparel.

Travel

As is true with most rewards programs, you’ll get the most value out of your Bilt points if you redeem them for travel. What’s unique about this rewards program is it allows you to transfer points to airline and hotel partners with a no annual fee credit card.

Transfer partners include:

- Air Canada Aeroplan

- Air France/KLM Flying Blue

- American Airlines AAdvantage

- Emirates Skywards

- Hawaiian Airlines HawaiianMiles

- Turkish Airlines Miles&Smiles

- Virgin Atlantic Flying Club

- World of Hyatt

Bilt points transfer to all programs at a 1:1 ratio. By doing so you’ll be able to redeem for flights on partner airlines as well, which really opens your options since you’ll have programs from all three major airline alliances to choose from.

Some examples of potential flights you could book with these programs include:

- Economy Class to UK from 10,000 points one-way (Virgin)

- Business Class to Hawaii on United for 12,500 points one-way (Turkish)

- Business Class to Europe from 53,000 points one-way (Air France/KLM)

- First Class to Japan on ANA from 55,000 points one-way (Virgin)

- Business Class to India on Qatar for 70,000 points one-way (American)

And these just scratch the surface. There are several other incredible travel deals you can get by transferring Bilt points to partner loyalty programs. You’ll typically get a much better value flying in premium cabins using points compared to what you would pay in cash for these flights. Of course, the best deals always depend on finding available award seats.

Related: How to Dramatically Slash Your Hotel Costs With These Priceline Tricks

Is Earning Bilt Rewards Points Worth It?

Whether or not you’ll benefit from the Bilt Mastercard depends largely on how much you pay for rent, your non-rent spend, and which other credit cards you hold.

There are several other credit cards out there where you’ll earn more than 1 point per dollar on everyday purchases, so spending a lot on your Bilt card instead just to increase the number of points you’ll earn on your rent payment may not make sense unless your rent is particularly high.

In any case, if you pay at least $1,500/month in rent, I’d say it’s worth it to find a way to put $250 in monthly spend on the Bilt Mastercard to at least reach Blue status. That way you’ll be earning at least 1,000 points per month, which would be the equivalent of earning 4x points on that $250 non-rent spend when you factor in the 750 points you’ll earn on your rent payment.

Likewise, if you are absolutely against the idea of paying an annual fee for a credit card, you’ll be hard-pressed to find another no annual fee credit card that earns points which can be transferred to several different airline partners.

The Bilt Rewards program is definitely a great way to earn points for what is generally everyone’s largest expense—rent. Since other travel rewards credit cards typically allow you to earn more points on everyday spend, I would recommend utilizing Bilt Rewards in combination with other programs such as Chase Ultimate Rewards, American Express Membership Rewards, Citibank ThankYou Points, or Capital One Venture Rewards, to give your points balance a little extra boost when it comes time to transfer for a travel redemption.

You’ll simply have to do the math to know what makes sense for you.